TAX OBLIGATIONS FOR RESIDENTS AND NON-RESIDENTS

WHY HAS THE ANDORRAN TAX SYSTEM BECOME ONE OF THE MOST ATTRACTIVE IN THE EUROZONE?

Its low tax rates, as well as the absence of a wealth tax or a succession and donation tax, are just some of the reasons why the Andorran tax system is one of the most attractive tax systems in the Eurozone. Andorran taxation has thus become one of the reasons why more and more people decide to move their residence to the Principality. But what are the main tax obligations in Andorra?

STATE TAX

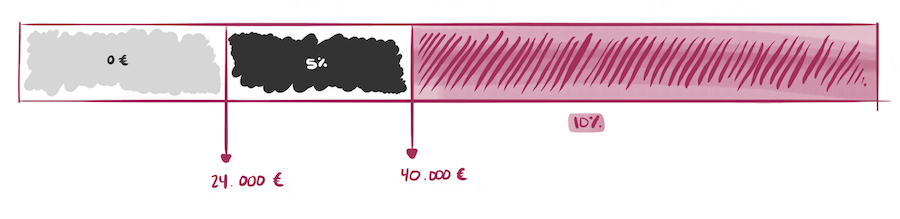

In relation to direct taxation; Individuals and companies, tax residents in Andorra, are taxed in the country on all world income received, with the Personal Income Tax (IRPF) and with the Corporation Tax (IS), respectively. Taxed at a tax rate of 10%, with some exemptions in case of personal income tax:

Personal income tax in Andorra

So how much IRPF (PIT) will I have to pay in Andorra?

With regards to indirect taxation; professionals, entrepreneurs and companies whose turnover exceeds 40,000€ must submit the Indirect General Tax (IGI) declaration, taxed at a rate of 4.5%.

Who pays and how much is the Capital Gains Tax and the Real Estate Property Transfer Tax?

If you are going to carry out a real estate operation in Andorra, you should know that these involve the payment of the tax on capital gains, as well as the payment of the tax on real estate transfers. The Capital Gains Tax shall be paid by the transmitter (who sells the property) at the time of sale. This tax is levied at a gradual rate of 1-15%, depending on the years the property was owned. Those who have owned property for more than 10 years are exempt from the tax. As for the buyer (the person purchasing the property), he must pay the Real Estate Transfer Tax, taxing 4% of the real value of the property, of that 4%, 1% goes to the Government and the remaining 3% goes to the Comú or municipality where the property is located. It should be noted, however, that the transfer of land or property between spouses or de facto partners, family members or affinity relations, up to the third grade, is exempt from taxation.

IRPF and IS

IRNR

IGI

IPTP and ITP

COMMUNITY OR LOCAL TAXES AND RATES

In addition to the above, both individuals and corporations may be subject to communal taxes or fees, linked to residence, the exercise of an activity or the owning of a property in a town or parish.

What local taxes and fees exist in Andorra?

-Those who own property will have to pay a property tax of about 0.55% on square meters. And if, in addition, that property is rented, they will have to pay the Rental Income Tax, which is 2-3% on the rent, depending on the municipality. The parish of Canillo does not apply these taxes.

–Individuals and companies, that are Andorran tax residents, must pay the Public Hygiene Tax which is between 30 and 50€, as well as the Public Lighting Tax, except in the Parish of Encamp, where there are no such taxes.

-For the granting of the authorization to establish a trade, the holder of the professional, commercial or economic activity must pay the Establishment Authorization Tax, which is between 23,50 and 120€, depending on the municipality.

-Those who engage in economic activity must pay the Tax on the Establishment of Commercial, Business and Professional Activities in the corresponding parish, from 0.5 to 2%, depending on the meters of the area being exploited.

WE WILL ADVISE YOU ABOUT HOW MUCH YOU WOULD SAVE BY CHANGING YOUR FISCAL RESIDENCE TO ANDORRA

Privacy Policy Summary

- Responsible for the treatment: ANCEI Consultoría Estratégica Internacional, SA

- Purpose: Manage the user’s request.

- Legal basis: The consent of the user.

- Recipients: Your data will not be transferred.

- Conservation: Maximum legal period established.

- Rights of the interested party: Access, rectify and cancel the data referring to your person, oppose the processing of the data, request the limitation of the treatment or the portability of the data.

Access to the Privacy Policy (Complete version).